Featured Knowledge Asset

The value of your IT — CapEx vs OpEX

Making the shift from buying IT to renting IT

**** as a Service has become one of the great paradigm-shifting change agents of the last 50 years.

No less powerful than the introduction of the computer or cellphone, * as a Service is now the prevailing IT operating model for small and large businesses alike.

A lot of old traditional operations of IT have already been swept aside, and still more are yet to fall bringing greater simplicity, flexibility, and different opinions about cashflow.

The original Software as a service has been joined by:

Application Contact Center Desktop

Infrastructure Platform SecurityAnd even more debut everyday:

Code Legal Management Network Power Print Vendor

The reason behind all this is simple:

Traditionally, tech equipment whether computers, cellphones, or network routers were considered as capital expenditures – CapEx by business finance and tax groups both of which see CapEx differently than OpEx – operating expenditures. Check-out Investopedia for the difference between the two.

Why is this important?

It all comes down to the all-mighty-dollar and how companies recognize and use cashflow

• Before *aaS, companies often bought each end-user a computer (sometimes just a desktop, sometimes a laptop, sometimes both) along with the accompanying monitor, keyboard, mouse, and operating system software, and software licenses for the software packages the user needed

• Companies bought office and/or cell phones for each user and the accompanying telephone or wireless service

• And companies bought business-wide equipment like network or telecom devices, printers, overhead displays, and a great deal other equipment for the office

All of this buying required the business to decide how to pay for all this equipment. It also increased the cost of employees, office spaces, and the business in general since the business either saves profits to pay for equipment or finances the purchases with debt.

If companies use free cashflow, they need to be careful and only spend making certain funds were not scarce. If purchasing through debt financing, this frees up cashflow but burdens the business with interest charges. Further, while depreciation is a business accounting trick to spread the cost of equipment over a longer timeframe tied to the useable life of the equpment, buying equipment does not always make the best sense for every business. Before *-as-a-service, renting tech equipment was difficult and resembled long-term purchase agreements with options to return the equipment.

The revolution of *aaS and shift to OpEx

*aaS fuels the shift toward operating expenditures (OpEx)

• Companies can choose to put the end-user computer in the cloud for a nominal monthly fee per user that turns out to be cheaper than the debt financing it via the CapEx model.

• Virtual office phones and cell phone costs have plummeted for business users and handsets manytimes can leased from carriers for low monthly fees or as extra benefits to wireless plans which now frequently include extra benefits such airline wireless purchasing options.

• Network-as-a-service has enabled savvy businesses to take advantage of paying for their high-end network equipment as part of a service plan rather than buying equipment and depreciating it over 10-15 years to recognize the investment value.

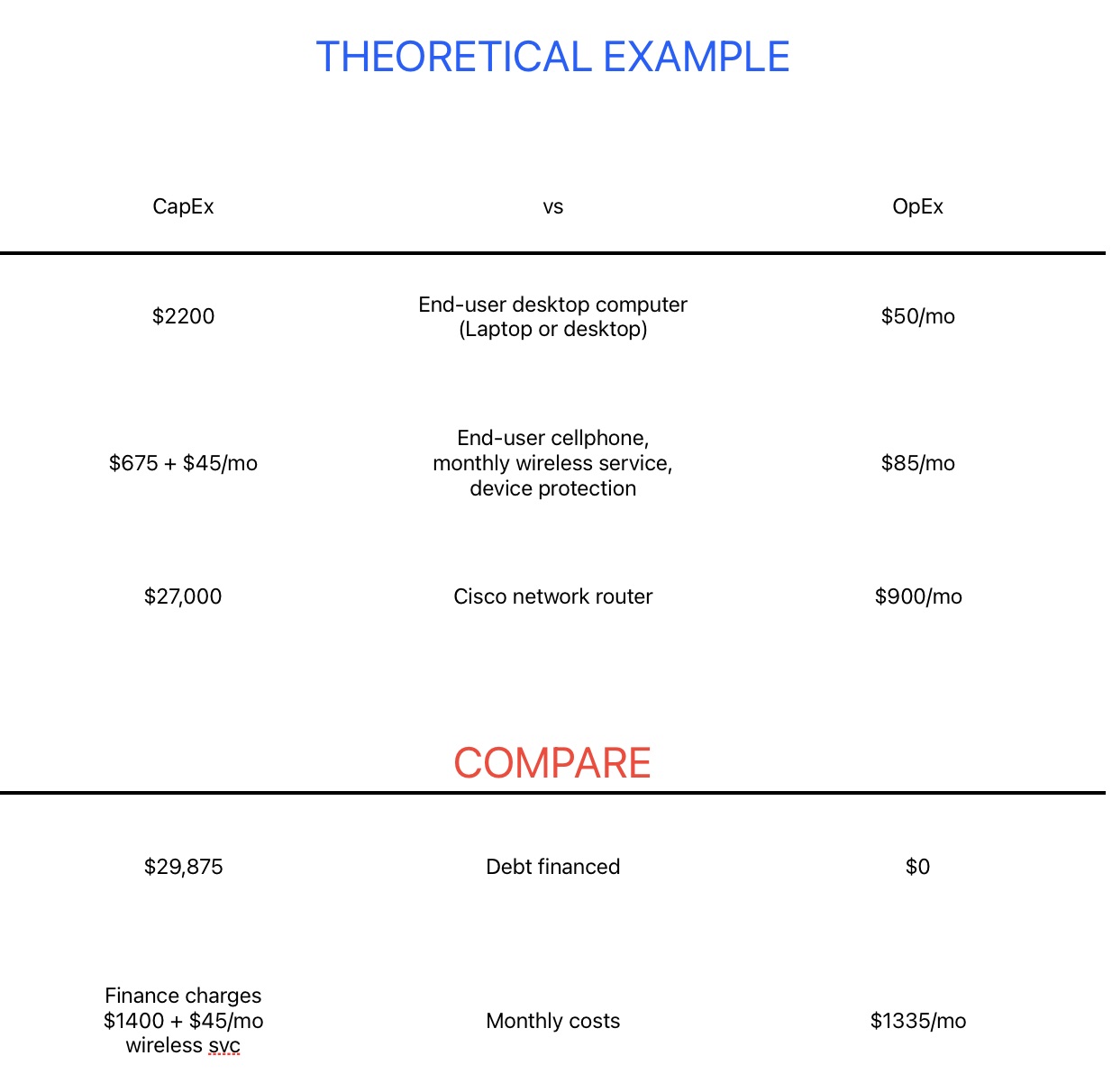

Compare using this example

Computer line item includes operating system license cost

CapEx and OpEx are reported on financial statements and treated differently under U.S. Tax Code. Talk to your tax advisor to figure out which is better for your business.